Office Hours

After Hours by Appointment

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Would you like to create a personalized quote?

Bryan Clark

Bryan Clark Ins Agcy Inc

Office Hours

After Hours by Appointment

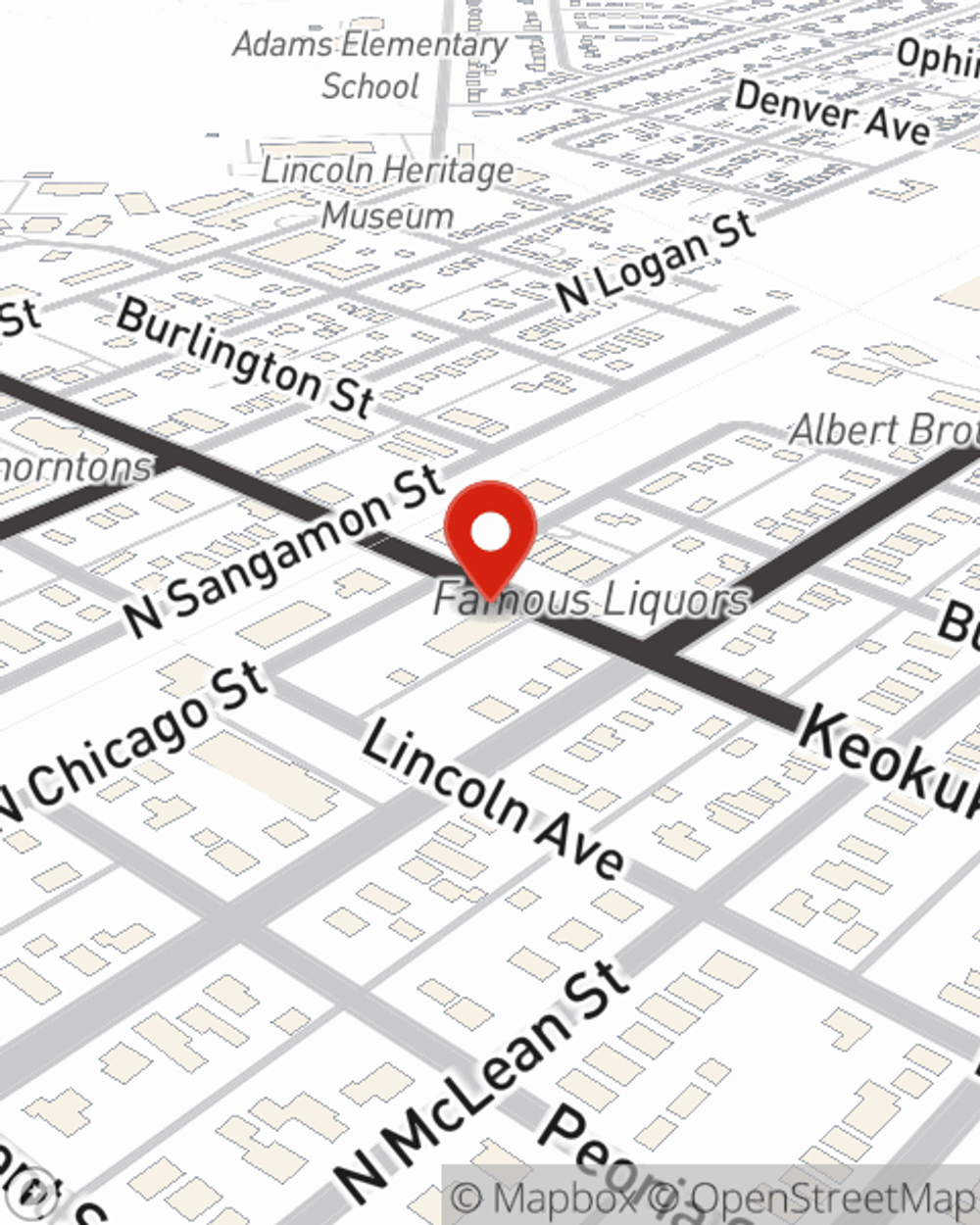

Address

Lincoln, IL 62656-2131

Office Hours

After Hours by Appointment

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Would you like to create a personalized quote?

Office Info

Office Info

Location Details

- Parking: In front of building

-

Phone

(217) 732-6211 (217) 651-4128

Languages

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Office Info

Office Info

Location Details

- Parking: In front of building

-

Phone

(217) 732-6211 (217) 651-4128

Languages

Simple Insights®

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

Special needs financial planning

Special needs financial planning

We review creating a special needs financial plan, which can ensure a family member with special needs receives the care they need.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Viewing team member 1 of 7

Donna Boyd

Office Manager

License #17510418

Viewing team member 2 of 7

Chloe Brocaille

Account Representative

License #20700454

Viewing team member 3 of 7

Beth Hoffert

Receptionist

Viewing team member 4 of 7

Reece Hooker

Customer Relations Representative

License #22068888

Viewing team member 5 of 7

Ashley Wilson

Customer Relations Representative

License #22068877

Viewing team member 6 of 7

Brooklyn Clark

Receptionist

Viewing team member 7 of 7

Burke Wilkin

Insurance Account Representative

License #22106743