Condo Insurance in and around Lincoln

Looking for outstanding condo unitowners insurance in Lincoln?

Cover your home, wisely

Your Stuff Needs Coverage—and So Does Your Condo Unit.

As with any home, it's a good plan to make sure you have coverage for your condominium. State Farm's Condo Unitowners Insurance has terrific coverage options to fit your needs.

Looking for outstanding condo unitowners insurance in Lincoln?

Cover your home, wisely

Condo Coverage Options To Fit Your Needs

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has dependable options to keep your most personal possessions protected. You’ll get coverage options to accommodate your specific needs. Thank goodness that you won’t have to figure that out by yourself. With empathy and terrific customer service, Agent Bryan Clark can walk you through every step to help build a policy that covers your condo unit and everything you’ve invested in.

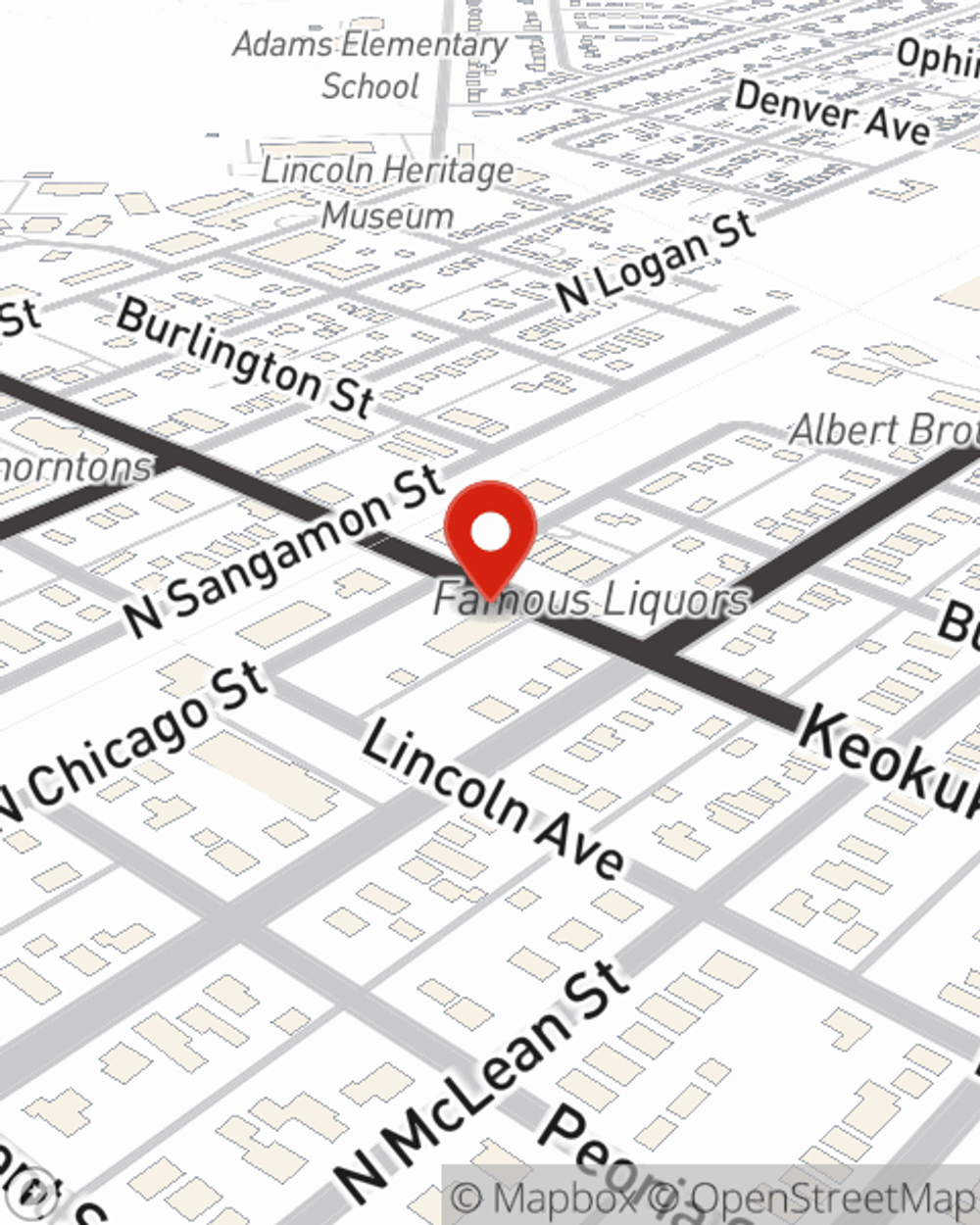

Getting started on an insurance policy for your unit is just a quote away. Contact State Farm agent Bryan Clark's office to check out your options.

Have More Questions About Condo Unitowners Insurance?

Call Bryan at (217) 732-6211 or visit our FAQ page.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Bryan Clark

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.